This is the worst financial crises since the great depression and now is clear that its not only about Wall Street but Main Street is hit badly as well. Again George Soros and Nouriel Rubini were right. But is not end of the world.

Today I was listening to Mohamed El-Erian co Head of Pimco (link here). I must admit I really like his suggestions to help global financial system. In his opinion today’s coordinated global central banks effort to liquidate the world financial system was step in right direction. But it still looks like all taken measures are not sufficient to prevent the worst case scenario. Mohamed is calling for emergency package which would include coordinated interest rate cut across the globe and capital injection. I think that the package which he called “4 bazookas fired at once” is type of the solution which is urgently needed now.

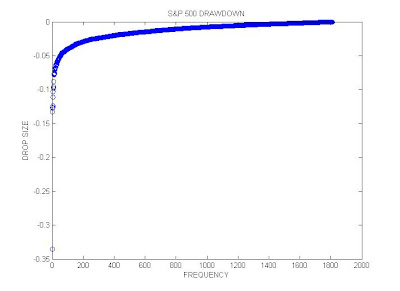

Although the current drop in stock indexes may be felt as disaster but it is not. Let’s put current situation into perspective. The chart shows the cumulative loss from the last maximum to the next minimum of the S&P500 index over the period of last 40 years. This statistics is called Drawdown. Drawdown is defined as a persistent decrease in the price over consecutive days and its distribution measures how the successive descents influence each other.

At normal times assumption about independence between the successive returns holds very well. However the large drops are not independent. At “special” times they may be burst of local dependence of the returns. In other words large loses can generate even bigger loses. It may be explained by psychological crowding effect or by risk management rules (stop loses triggering) etc. In last 40 years biggest drawdown took 33% of its value within 4 days.

So far FED, US Treasury and most recently ECB, BOJ, BOE actions prevents worst case scenario to materialize. But authorities must stay ahead of the curve and additional measures are needed (4 bazookas). I convinced that all needed measures will be implemented and floor for the global indexes will be put around current levels.

Thursday, September 18, 2008

Worst case scenario is most likely to be avoided

Posted by

Piotr Chwiejczak

at

2:42 PM

3

comments

![]()

Labels: coordinated intervention, drawdown, El-Erian, SP500 plunge

Monday, September 1, 2008

In October S&P 500 index is likely to retest recent lows

This post is an update to the S&P500 prediction posted on this blog earlier in July. The prediction comes true as well as oil bubble burst forecast issued here. However the S&P index did not plunge as low as 1150 points but the critical time prediction was quite accurate. Also it has to be remembered that critical time obtained from LPPL models is only the most probable point of trend reversal. Financial markets are complex and open systems and its valuation oscillations are driven both by endogenous end exogenous factors. In July In my assessment S&P500 price dynamics was strongly affected by SEC naked short-selling ban on the stocks of major financial institution. But take me correct I don’t think that SEC decision was wrong on contrary I think it was absolutely correct and needed as it break negative feedback loop.

Here I want to make an update to my earlier prediction of S&P500 based on LPPL model. An LPPL model applies concepts of criticality from statistical physics however I will not focus here on the theory complex systems (nice and easy to read easy on complex system and LPPL models you can find here .)

One approach in studying such systems is the recording of long time series of several selected variables (observables), which reflect the state of the system in a dimensionally reduced representation

In 2000-2003 anti-bubble/bear phase The S&P500 index shows clear oscillations with 5 sharp local minima and the self similar structure and the scaling exponent was easy to find.

The local minima are dated as follows: m5=12-Oct-2000; m4=20-Dec-2000; m3=04-APR-2001; m2=21-SEP-2001; m1=23-July-2002.

(Mn-Mn+1)/(Mn+1-Mn+2)=(Mn+1-Mn+2)/(Mn+2-Mn+3)=λ

Using the previously determined minima M1,…,M5 we get

(m1-m2)/(m2-m3)=λ1=1.79

(m2-m3)/(m3-m4)=λ2=1.62

(m3-m4)/(m4-m5)=λ3=1.52

The main disadvantage of the Shrank’s transform presented above it that it needs quite a long time series to determine the preferable scaling factor of the system. Although in the current bearish pattern of the S&P 500 index also shows strong oscillations but the time series is much shorter and its much harder to determine the scaling parameters. So instead of Shrank’s transform I implemented the Lomb spectral analysis. I done the computation in Matlab using procedure written by Brett Sholeson. After visual analysis of the S&P500 index I chose for critical time tc=10-10-2007, then the data was detrended.

The Lomb periodogram (chart 2) exhibit an extremely significant peak close to log-frequency f=w/2π=2.6 with the amplitude larger than 60. Second peak is close to 2w log frequency which suggest the presence of harmonic anagular. The visual structure of the current S&P500 time series with double minima pattern also suggest suggest the presence of a rather strong harmonic at the angular logfrequency.

The data fit quite well to the formula. Numbers on horizontal are counting the distance in trading days from the critical time tc=10-10-2007Below I put the chart with the forecast for S&P 500 index from the LPPL model. The forecast suggest that the next minima S&P500 index will reach in October/November and the index should rally into year 2009 when the trend should turnaround toward new minma.

Read More......